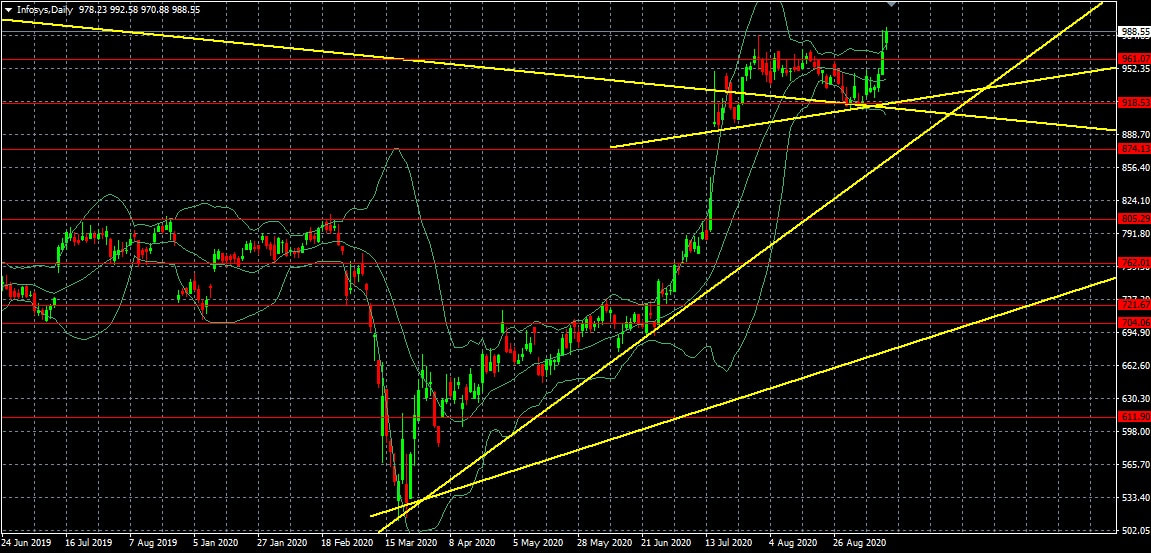

Infosys Technical Analysis Report – 15-09-2020

Daily Chart (988.55)

HISTORICAL PRICE ACTION ANALYSIS

Short Term Trend: Upward

Long Term Trend: Upward

Range: 512 to 961

Buying Pressure: Above 805

Resistance: 1036, 1109, 1273, 1458

Support: 961, 918, 894, 874, 805, 762, 721, 704, 612

Movement in the past few weeks: Upward

Movement in the past few days: Resistance Breakout

EXPECTED FUTURE PRICE ACTION

Reversal Expected/ Correction: Chances are low

Expected movement in the next few days: Upward

Expected Short Term Trend: Upward

Expected Range: 704 to 1273

Expected Buying Pressure: Above 1036

Expected Selling Pressure: Below 874

Trading with proper stop loss (may be in between 40-50 points) depending upon the volatility will limit the trade risk exposure. Any trigger of stop indicates further revision of strategies as stop loss trigger can drag the prices further in the same direction of stop loss or a change in price direction. So one should be careful and should watch the prices for some time before taking any decision on such events. Any range breakout or breakout below support levels may create significant selling pressure that may drag the prices to its next support level. Any range breakout or breakout above resistance levels may create short term buying pressure that may allow prices to appreciate further to its next resistance level.

Short Term Trend: Upward

Long Term Trend: Upward

Range: 512 to 961

Buying Pressure: Above 805

Resistance: 1036, 1109, 1273, 1458

Support: 961, 918, 894, 874, 805, 762, 721, 704, 612

Movement in the past few weeks: Upward

Movement in the past few days: Resistance Breakout

EXPECTED FUTURE PRICE ACTION

Reversal Expected/ Correction: Chances are low

Expected movement in the next few days: Upward

Expected Short Term Trend: Upward

Expected Range: 704 to 1273

Expected Buying Pressure: Above 1036

Expected Selling Pressure: Below 874

Trading with proper stop loss (may be in between 40-50 points) depending upon the volatility will limit the trade risk exposure. Any trigger of stop indicates further revision of strategies as stop loss trigger can drag the prices further in the same direction of stop loss or a change in price direction. So one should be careful and should watch the prices for some time before taking any decision on such events. Any range breakout or breakout below support levels may create significant selling pressure that may drag the prices to its next support level. Any range breakout or breakout above resistance levels may create short term buying pressure that may allow prices to appreciate further to its next resistance level.

RSS Feed

RSS Feed