GBPUSD Technical Analysis Report for the Month Ahead – 28-06-2018

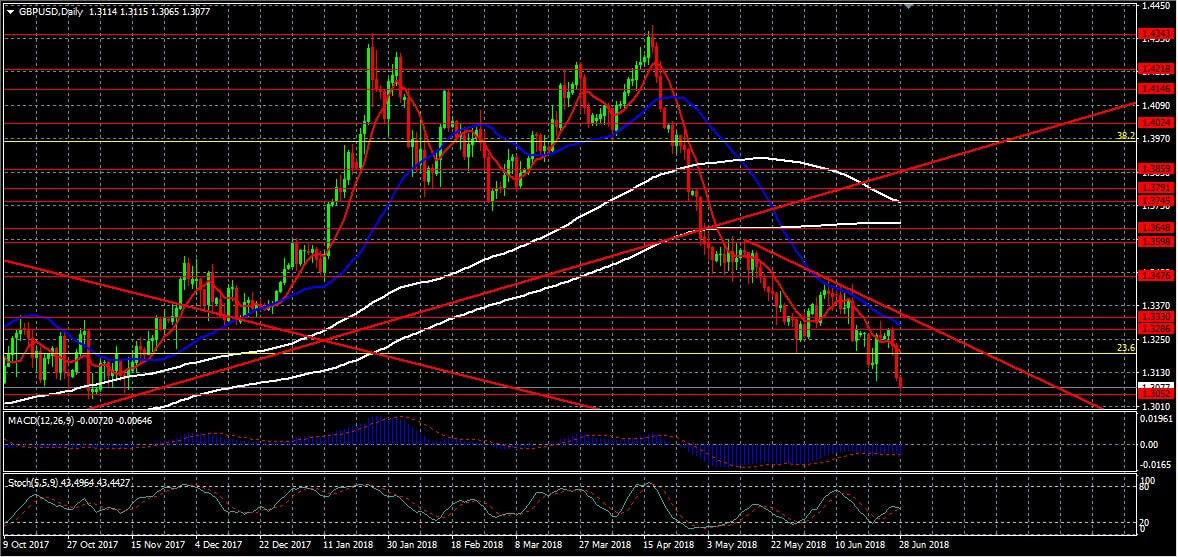

Daily Chart (1.3090)

As per the daily GBPUSD candle stick chart, we can clearly notice that the currency pair, currently trading at 1.3090 levels is moving in a downward trend and has broken major support levels of 1.3286 and 1.3197. The pair is also trading below its long term moving averages. As per our analysis and technical indicators, we are expecting the currency pair to depreciate further from its current levels but there may be some short term correction to 1.3286 and 1.3330 levels due to major resistance levels. We are expecting the GBPUSD to have major resistance at 1.3330 and the currency pair may again start depreciating from that level. Any breakout above 1.3330 levels may force the currency pair to appreciate further to 1.3476 and 1.3598 levels. And any breakout below 1.3052 levels may trigger further downside movement to 1.2867 and 1.2708 levels. Any breakouts of support or resistance levels are important as breakouts may trigger further movement in the same direction.

Major Support and Resistance:

Resistance: 1.3197, 1.3286, 1.3330, 1.3476, 1.3598, 1.3648, 1.3745, 1.3791, 1.3859

Support: 1.3052, 1.2867, 1.2708, 1.2337, 1.2151, 1.1959

So as per the technical analysis, the ideal strategy for trading GBPUSD in the next few days should be:

Selling at 1.3330 levels with a Stop at 1.3360, Target at 1.2867 and 1.2708 levels.

Buying GBPUSD above 1.3360 with a Stop at 1.3330, Target at 1.3476 and 1.3598 levels.

Selling below 1.3050 levels with a Stop at 30 pips, Target at 1.2867 and 1.2708 levels.

Buying at 1.3065 with a Stop at 1.3035 and Target at 1.3197, 1.3286, 1.3330, 1.3476, 1.3598, 1.3648.

Any trigger of stop indicates further revision of strategies as stop loss trigger can drag the prices further in the same direction of stop loss or a change in price direction. So one should be careful and should watch the prices for some time before taking any decision on such events.

Major Support and Resistance:

Resistance: 1.3197, 1.3286, 1.3330, 1.3476, 1.3598, 1.3648, 1.3745, 1.3791, 1.3859

Support: 1.3052, 1.2867, 1.2708, 1.2337, 1.2151, 1.1959

So as per the technical analysis, the ideal strategy for trading GBPUSD in the next few days should be:

Selling at 1.3330 levels with a Stop at 1.3360, Target at 1.2867 and 1.2708 levels.

Buying GBPUSD above 1.3360 with a Stop at 1.3330, Target at 1.3476 and 1.3598 levels.

Selling below 1.3050 levels with a Stop at 30 pips, Target at 1.2867 and 1.2708 levels.

Buying at 1.3065 with a Stop at 1.3035 and Target at 1.3197, 1.3286, 1.3330, 1.3476, 1.3598, 1.3648.

Any trigger of stop indicates further revision of strategies as stop loss trigger can drag the prices further in the same direction of stop loss or a change in price direction. So one should be careful and should watch the prices for some time before taking any decision on such events.

RSS Feed

RSS Feed